Some urgent mechanisms and policies to develop production, business and help revive the economy affected by the COVID-19 pandemic

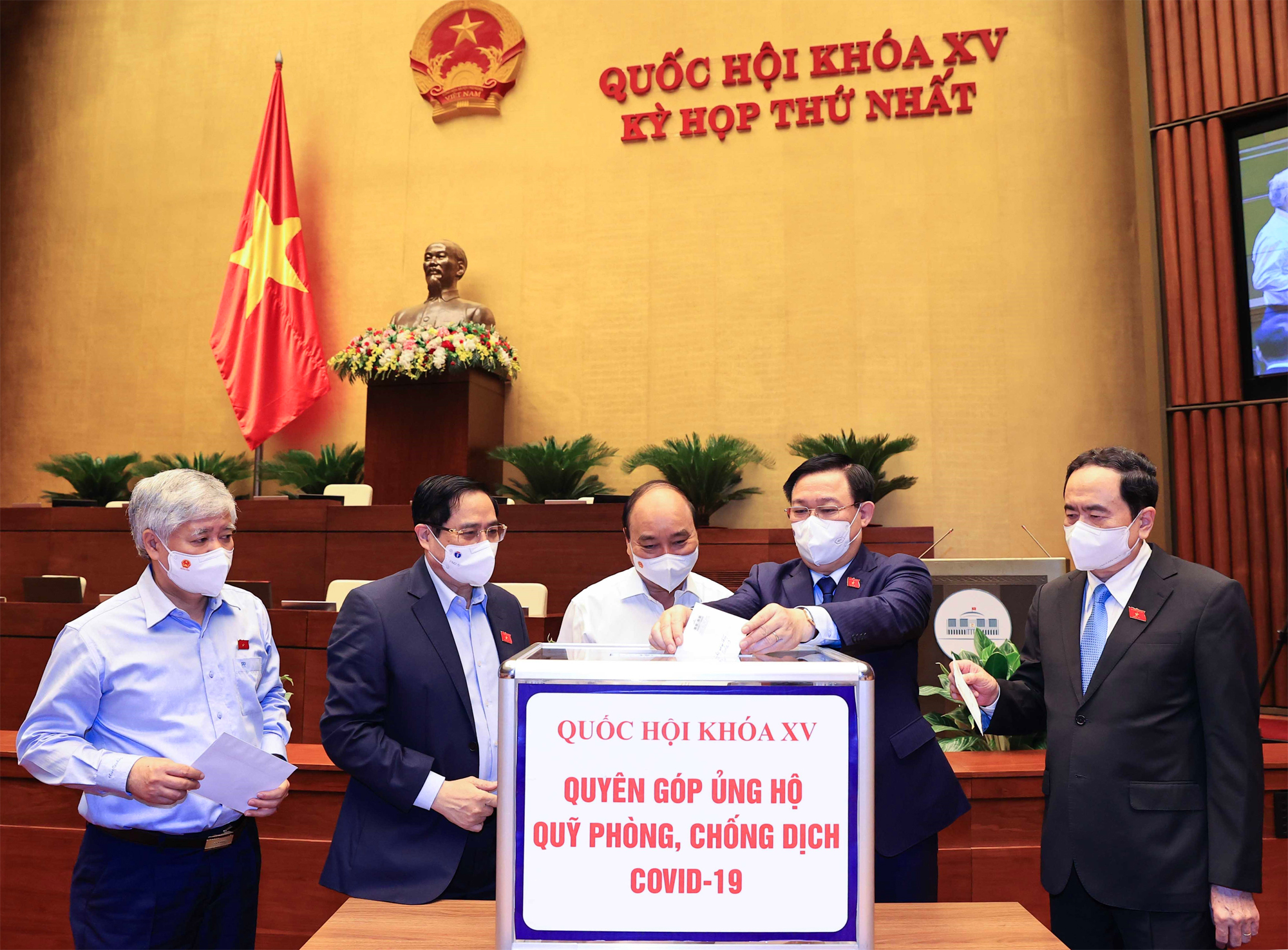

Politburo Members: State President Nguyen Xuan Phuc, Prime Minister Pham Minh Chinh, National Assembly Chairman Vuong Dinh Hue and National Assembly deputies donated to support the COVID-19 vaccine fund _Photo: VNA

Communist Review - The COVID-19 pandemic has complicated and unpredictable developments. In Vietnam, the fourth outbreak due to the fast-spreading Delta variant has taken a heavy toll on all aspects of socio-economic life, production, and business activities of enterprises and people. To recover production, business, and economy affected by the coronavirus, it is urgent to adopt mechanisms, policies, and an appropriate roadmap.

Overview of COVID-19 impact on production and business operations

In 2020, Vietnam is one of the world's economies that can maintain growth momentum. However, its economic growth only reached 2.91%, the lowest in the period 2011 - 2020; GDP in the first 6 months of 2021 only reached 5.64%, lower than the set target. Although this rate has increased significantly compared to the same period in 2020 (1.82%), it is still not equal to that achieved in the same period in 2018 and 2019 (7.05% and 6.77%, respectively). Investment by the non-state sector and foreign direct investment (FDI) was low. Investment capital from the non-state sector in 2020 only increased by 3.1%, in the first 6 months of 2021, an increase of 7.4% compared to the same period. Total FDI capital into Vietnam in 2020 decreased by 25% compared to 2019. In the first 6 months of 2021, it fell by 2.6%. Unemployment and underemployment rates increased. In 2020, the unemployment rate of the working-age group was 2.48% (compared to 2.17% in 2019), the underemployment rate was 2.51% (1.5% in 2019). In the second quarter of 2021, the unemployment and underemployment rates were 2.4% and 2.6%, respectively, an increase compared to the first quarter of 2021 (2.19% and 2.2%, respectively).

These statistics reflect the difficulties faced by businesses. In 2020, the number of new businesses registered decreased by 2.3% compared to 2019; the number of businesses suspending operations temporarily, stopping operations while waiting for dissolution procedures, and businesses completing dissolution procedures increased by 13.9%. Most of the enterprises had to suspend their business and have dissolved in the trade and service sector; the number of large-scale businesses withdrawing from the market has increased sharply. In the first 8 months of 2021, compared to the same period of the previous year, the number of newly - established enterprises decreased by 8% in the number of enterprises, 7.5% in registered capital, and 13.8% in the number of employees; total additional registered capital declined by 17%; the number of businesses returning to operation decreased by 0.6%. Businesses were affected on a large scale, especially micro and small businesses. Production and business activities of cooperatives, inter-cooperatives, and groups of cooperatives (hereinafter referred to as cooperatives) were heavily hit. More than 90% of cooperatives showed a decline in revenue and profit; the number of employees who are cut or quit without pay accounted for more than 50% of the total workforce. The People's Credit Fund faced difficulties.

The industry, trade, and service sectors have witnessed a drop in growth rate in 2020, the lowest between 2011 and 2020. The industrial sector only grew by 3.36%, of which the processing and manufacturing industry only increased by 5.82%. The trade and service sector increased by 2.34%, equivalent to only one-third of the growth rate recorded in 2019, of which accommodation and catering business declined by 14.68%, transportation and warehousing services down 1.88%. In the first 6 months of 2021, due to the impact of lockdown in some localities, the service sector continued to see a drop in growth rate with 3.96% over the same period in 2020; the accommodation and food services industry continued to fall deeply (5.12%), transportation and warehousing went down by 0.39%. In 2020, travel and tourism revenue accounted for 0.3% of total retail sales of consumer goods and services, down by 59.5% over the previous year; The first 6 months of 2021 witnessed a drop of 51.8% compared to the same period last year. Newly established private education and training institutions at all levels in 2020 reduced by 9.5% over the same period last year. The country saw a surge in the number of buninesses registered to temporarily suspend operations or dissolve, an 89.6% and 32.8% rise, respectively. In the first 6 months of 2021, the number of businesses returning to operation dropped by 0.2%.

The real estate business is strongly influenced in the segments of residential real estate (social housing, cheap commercial housing), offices for rent, tourist and resort real estate; The tendency of shifting investment to the real estate market makes the market more vibrant in other segments but leads to land fever phenomenon, speculation, and misinformation in the land – use planning, especially in suburban areas, thus leading to an asset bubble and macroeconomic risks.

Consumption of fresh/frozen and seasonal agricultural and aquatic products was greatly affected; Although agricultural commodity prices fell on the spot, their selling price to domestic consumers did not decrease. Some other industries and fields were greatly affected since the beginning of the epidemic outbreak, including textiles and garments and leather production, leather products, consumer electronics, automobile manufacturing and assembly, and so forth.

General assessment on policies responses to pandemic impacts on production and business activities

To remove difficulties, promote production and business and create economic recovery, the Politburo, National Assembly, National Assembly Standing Committee, Government, Prime Minister as well as ministries and branches have issued several guidelines, policies, and measures to promptly respond to the epidemic(1).

In general, the issued policies and solutions have a combination of fiscal policy, monetary policy, and other sectoral or social security support policies, including short-term and long term solutions to address challenges for economic growth, and support individuals and businesses; they are basically consistent with the evolution and impact of the epidemic, similar to the new approach adopted by many countries around the world, and are highly appreciated by the people and business community. The policies are implemented at low cost, thus not affecting the major balance of the economy, and at the same time, preserve fiscal space to develop and implement solutions in the next period. As a result, they have made an important contribution to stabilize the macro-economy, ensure social security, and help Vietnam achieve a positive economic growth rate in 2020, maintaining the country's positive economic outlook in the medium and long term and strengthening people's and businesses trust in the guidelines and policies of the Party and State.

Besides the effectiveness of the issued policies and solutions, there are also some limitations and obstacles in the implementation process, such as: 1- The promulgation of guidelines for implementation of some measures adopted by the National Assembly, the Standing Committee of the National Assembly is not timely; policy’s implementation is still slow; 2- The organization and implementation of some policies are not up to par; disbursement rate is low due to strict requirements during the first period of epidemic, procedures are cumbersome and inflexible; Information and instructions are not timely provided, thus causing obstacles to enterprises, especially small and micro enterprises, and household businesses; 3- Many difficulties accumulated up to now are not only specific problems of enterprises but have become common problems of industries and fields. Currently, there still exist temporary policies for short term response instead of long term policies at a larger scale that can help long-run economic recovery in the direction of recovery; 4- The deployment of COVID-19 vaccination strategy has progressed slowly.

The main reason resulted from the complicated and unpredictable trajectory of COVID-19 pandemic as well as the fast spread of Delta variant, causing great pressure on time and workload when issuing support policies. The full impact, nature, scale, and urgency of an epidemic like COVID-19 were not correctly identified by policy makers. Forecast capacity and database are still weak, while the competitiveness of Vietnamese enterprises is not up to par.

Politburo Member, National Assembly Chairman Vuong Dinh Hue visits Nhan Co Aluminum Factory of the Dak Nong Aluminum Company - TKV, Vietnam National Coal and Mineral Industries Holding corporation limited (in Nhan Co commune, Dak R'lap district, Dak Nong province) _Photo: VNA

Some urgent mechanisms and policies to strongly promote production and business activities and economic recovery

Firstly, effective epidemic control is a prerequisite and a decisive factor for economic recovery and minimizing losses resulting from the pandemic. It is necessary to be more determined in taking epidemic control measures, especially in dynamic areas, major cities, and localities where are situated industrial zones. Promote the vaccination strategy, mobilize all necessary resources to have enough free COVID-19 vaccines to immunize the entire population soon, strive to achieve the vaccination rate of 70% of the total population as early as possible; promulgate a list of localities, sectors, and fields that are prioritized for vaccines so that local authorities, businesses, and inhabitants could build a plan to maintain socio-economic activities, production, business. Timely promulgate guidelines, create favorable conditions for businesses to import quality vaccines, and purchase machinery and equipment for epidemic prevention and control. Recognize vaccine passports issued by other countries; effectively maintain and regularly update the information and data system on COVID-19 vaccination to strengthen epidemic prevention and ensure social safety. Allocate and effectively use financial resources mobilized from society for COVID-19 response fund launched by the Central Committee of the Vietnam Fatherland Front; accelerate the disbursement of the COVID-19 vaccine fund.

Secondly, raise awareness about the “new normal” context that the epidemic could persist for a long time and negatively impact socio-economic life even if the vaccination rate reaches 100%. For challenges in the next period, it should pay particular attention to the following ones: inflation risk resulting from stimulus packages in response to the COVID-19 pandemic of many countries; supply chain disruption and production stagnation, the global recession that could last a long time; decline of domestic and international investment capital flows; higher technical barriers in the context that during the post COVID-19, countries could tend to make a trade with countries and regions that control the epidemic...

Thirdly, take consistent and coherent measures from the central to local levels to balance supply and demand in the market, maintain production, supply, circulation, and transportation of goods, stabilize the domestic consumer market. Ensure macroeconomic stability; maintain financial and monetary stability. Closely coordinate and flexibly manage monetary policy, credit policy, fiscal policy, and social security policy by playing to the fullest extent all available resources. From the economic point of view, give a helping hand to businesses, households, and individuals to promote production and business, thus directly enabling economic growth and social life stabilization. Therefore, social support must be drastic, continuous, transparent, public for appropriate beneficiaries, timely and accessible; the scale of social assistance must be commensurate with the severe impact of the epidemic; conditions and standards of support packages must be feasible; the processes and procedures to receive social support must be simplified; In addition, there should adopt a mechanism to closely monitor and inspect the implementation and handle sanctions to stop profiteering amid COVID-19 pandemic. In case of incompetence, it is urgent to report and submit to the National Assembly, the National Assembly Standing Committee for the promulgation of necessary policies to remove difficulties and maintain production, business, and economic development according to Resolution No. 30/2021/QH15 dated July 28, 2021. Specifically, the measures are as follows:

First of all, continue to direct the effective implementation of mechanisms and policies according to Resolution No. 63-NQ/CP, Resolution No. 68/NQ-CP, and related documents, especially new policies (such as supporting training activities to improve vocational skills, reducing occupational accident and disease insurance premiums, reducing telecommunications charges and so forth). Regularly monitor the implementation process, review and evaluate the effectiveness and feasibility, identify problems and inadequacies in order to make timely adjustments so that policies are fully implemented and meet set targets to maintain social trust. Take effective measures to ensure smooth and efficient transportation and circulation of goods, deal with the disruption of supply chains and value chains: ensure smooth transport in emergency vehicle lanes; promulgate classification rules against the COVID-19 epidemic that are uniformly applied across the country, avoid excessive localization that could hinder business operations; fully assess the feasibility and effectiveness of models “a single itinerary, two destinations”, “a single itinerary, multiple destinations”, the “three-on-the-spot” strategy and measures to support businesses in implementing this model... Strengthen propaganda, promote the role of associations to provide accurate information, advice, support, and create favorable conditions for businesses, cooperatives, and people to access the issued support packages.

Second, continue to examine and early issue policies to help those hit hardest by the COVID-19 pandemic by clarifying eligible beneficiaries and sectors to suit the actual situation and anti-epidemic strategies, economic recovery and social security goals in each period, such as: Cutting corporate income tax for eligible businesses and business households that saw drop in revenue due to the epidemic, expanding the scope of supporting policies to micro, small and medium sized enterprises; continue to extend the deadline for payment of tax payment and land rent; continue to reduce tax, extend the payment deadline of excise tax, or special consumption tax, for domestically manufactured or assembled cars; supplement the value-added tax reduction policy for business, business households and individuals heavily affected by the epidemic to reduce the selling prices of goods and services, and input costs for other business sectors so that consumers are the beneficiaries and enterprises do not increase the selling prices to seek profit by manipulating public policy; supplement the policy of exempting late payment interest arising in 2020 and 2021 for organizations and individuals directly affected by the COVID-19 epidemic, which incur losses in production and business; support COVID-19 testing fee for businesses; extend the scope of beneficiaries who are accessible to reduction in electricity prices and bills to support their production and business operations; reduce deposits for tourism businesses; consider adopting policies to support production and business premises; exempt road maintenance fees; extend the deadline for vehicle accreditation; develop an overall support plan for aviation enterprises; allow the extension or postponement of payable debts for enterprises that build social houses, commercial houses with an estimated selling price of less than 25 million VND/m2 and tourism real estate projects; consider easing requirements for credit risk management at commercial banks; continue to deploy the loan interest rate support package for businesses; reduce trade union fee from 2% of the employee’s salary fund to 1%; allow enterprises to increase overtime work by more than 40 hours/month to handle urgent tasks and backlog of work; adopt policies to support fees and freight for air and maritime transportation for key markets (the US, Europe, the Middle East) to improve domestic competitiveness and reduce costs for businesses; reopen as early as possible international flights to/from COVID-19 safe countries, facilitate trade activities and aid the national economic recovery; complete new COVID rules for entry into Vietnam, prioritize experts entering Vietnam to operate production and business; review, supplement, and clearly prescribe policies to support cooperatives... Evaluate socio-economic performances in the first months of the year, and build an annual socio-economic development plan for 2022 to reach socio-economic development goals for the period of 2021 - 2025.

Third, examine and develop without delay a feasible economic recovery and development program. Consider promulgating long-term fiscal, monetary, and social security policies for the period 2021 - 2025 to stimulate the economy rather than simply adopting supporting packages (by allowing businesses to restructure their loans, extending debt payment deadline, reducing or exempting some types of taxes and fees, exempting and extending the application deadline of some regulations that make raised costs for production and business activities, reducing interest rates for customers, granting new loans to increase working capital to help enterprises and households revive their production and business activities and stimulate domestic demand...); The Government should consider promulgating a Resolution on supporting and developing businesses between 2021 and 2025 and the Program to support small and medium enterprises in 2021 - 2025 in a synchronous manner to optimize resources; direct the implementation of support programs to ensure effectiveness and feasibility. Promote the implementation of overall policies on institutional reform, improve the business and investment environment, cut costs for businesses, create a new driving force for economic growth; restructure the whole economy in association with renovating the growth model, improve productivity, quality, efficiency, and competitiveness, enhance the self-reliance of the economy amid changing post-pandemic realities; increase the mobilization, allocation and effective use of resources, step up the construction and development of a synchronous and modern strategic infrastructure system; promote import and export toward a harmonious and sustainable trade development; improve the quality of human resources, develop and invest in educational programs with necessary skills for jobs in the “future market” in order to create a dynamic Vietnamese economy that could face the future global supply chain transformation. Among measures to take, due attention should be paid to the following ones:

- Strictly obey the Law on Promulgation of Legal Documents. Actively implement relevant laws to promote production and business activities. Finalize the amended Land Law project on time. Accelerate the submission of the project of Law amending and supplementing a number of articles of the tax laws or comprehensively amending the tax laws. Improve the efficiency of the inspection and review of legal documents to detect conflicting and overlapping regulations that are no longer consistent with reality in order to timely handle inadequacies or recommend competent agencies to tackle problems arising, promoting investment, production, and business operations. Complete without delay the Dossier of proposal to the Law Amending and Supplementing Laws to remove difficulties for investment and business during the COVID-19 pandemic to submit to the National Assembly and the National Assembly Standing Committee under the law. Continue to simplify business conditions, administrative procedures, cut unnecessary and unreasonable regulations hindering production and business activities of organizations and individuals. In 2021, it is essential to conduct an evaluation of the progress made in the implementation of all resolutions, decisions, and directives on improving the business environment and cutting costs, thereby building the Master Program on State administration reform, improving national competitiveness, implementing the Resolution of the 13th National Party Congress and restructuring the national economy and promoting post-COVID-19 economic recovery.

Direct to speed up the formulation of plannings for the period 2021 - 2030 in accordance with the Law on Planning to submit to the Prime Minister for approval; complete the dossier of the National Land Use Plan from 2021 through 2030, with a vision to 2050 and the Land Use Plan in 2021 - 2025 and submit it to the competent authorities; promptly submit to the National Assembly for approval the National Master Planning and the National Marine Spatial Planning.

- A due consideration should be given to tackling obstacles facing “leading” industries and fields, businesses that make significant contributions to the state budget, created a large number of jobs, thus facilitating positive spillover effects, creating new fiscal space for economic growth, promptly responding to the needs of the world that is gradually opening up after the pandemic instead of spreading resources too thin. Develop a plan to restructure the economy in 2021 - 2025 by identifying impacts of the pandemic, and submit it to the National Assembly.

- Finalize and effectively organize the implementation of the Scheme on restructuring state-owned enterprises for the period of 2021 - 2025.

- Particular attention should be paid to controlling inflation and capital flows into the stock market and real estate market. Keep an eye on interest rates to take appropriate measures in case of crisis; strike a balance between bank profitability and enterprises' difficulties in loan interest rates, implement a good Net Interest Margin (NIM). Take effective measures to deal with bad debts, reduce newly arising bad debts as well as create favorable conditions for the financial credit system to restructure its debts and delay debt repayments to give businesses a helping hand.

- Prioritize the development of the private economy, digital economy, green economy, support businesses and households to speed up digital transformation, change business models, renovate technology. Accelerate the implementation of the National Digital Transformation Program to 2025, with orientation to 2030 and the National Strategy developing Vietnamese digital technology companies by 2030. Encourage venture capital investment, research and development activities in the private sector. Build a solid foundation for e-commerce growth through three decisive factors: logistics, e-payment, and cyber security. Urgently build legal frameworks to create a basis for the practical implementation of new business models, new business products, digital currency, e-banking, and financial technology (FinTech)... Focus on training digital human resources, skilled human resources to meet the demands of the Fourth Industrial Revolution, promote the labor shifting. Enhance digital capabilities for small and medium enterprises and micro - enterprises. Increase access to the internet and mobile broadband subscriptions among inhabitants, especially ethnic minority populations from remote and mountainous areas. Adopt transparent rules and regulations on data management. Consider issuing policies to support science and technology enterprises.

- Continue to accelerate the implementation of public investment projects, notably major infrastructure projects that have positive spillover effects and create a driving force for socio-economic growth, especially inter-regional projects, projects on climate change mitigation and prevention, control of natural disasters as well as those on national digital transformation.

- Adopt policies to boost domestic consumption, promote communication in response to the campaign “Vietnamese people give priority to using Vietnamese goods”. Promulgate as early as possible a Decree stipulating the origin of Vietnamese products.

- Focus on developing the domestic market, take effective solutions to stimulate domestic consumption, especially in tourism, retail, transportation, accommodation, and restauration.

- Regularly monitor, update and evaluate the world trade situation and make forecasts. Effectively implement Action Plan for Vietnam’s free trade agreements implementation to boost exports, especially to markets with plenty of room to grow. New generation free trade agreements and new free trade agreements that have been recently signed are expected to create big changes in shaping the global supply chains; make full use of this opportunity and actively respond to the global trade competition and conflicts.

- Find solutions to cope with the mass exodus of workers who flee big metropolitan areas: Aid businesses to attract the workers back to the workplace in industrial parks and cities after COVID-19 to help revive their production operations; Furthermore, localities need to develop plans to create jobs for returning workers who are not ready to return to industrial parks and big cities, on worries they would get stuck again if there was another wave of infections; pay attention to deal with security issues to avoid social instability.

- Consider building an automatic emergency response plan with qualitative and quantitative thresholds that can be "activated immediately" in case of crisis, pandemic, or other disasters/.

------------------

(1) Conclusion No. 77-KL/TW dated June 5-6, 2020, Conclusion No. 07-KL/TW dated June 11, 2021, of the Politburo; Resolution No. 116/2020/QH14 dated June 19, 2020, Resolution No. 30/2021/QH15 dated July 28, 2021, Resolution No. 124/2020/QH14 dated November 11, 2020, of the National Assembly; Resolution No. 268/NQ-UBTVQH15 dated 6-8-2021 of the National Assembly Standing Committee; Resolution No. 42/NQ-CP dated April 9, 2020, Resolution No. 154/NQ-CP dated October 19, 2020, Resolution No. 84/NQ-CP dated May 29, 2020, Resolution No. 63/ NQ-CP dated June 29, 2021, Resolution No. 68/NQ-CP dated July 1, 2021, of the Government, and other resolutions, decisions, decrees, circulars, and documents.

This article was published in the Communist Review No. 975 (October 2021)